São Paulo, January 16, 2025 – IBOPE Repucom has released its latest “Sponsorship Map of Football Uniforms in Brazil” for 2024. This comprehensive study analyzes the sponsors adorning the uniforms of Série A clubs, categorizing them by placement on the kit and industry sector. It provides a detailed overview of the sponsorship market within Brazil’s elite football league, offering key insights into trends and market dynamics.

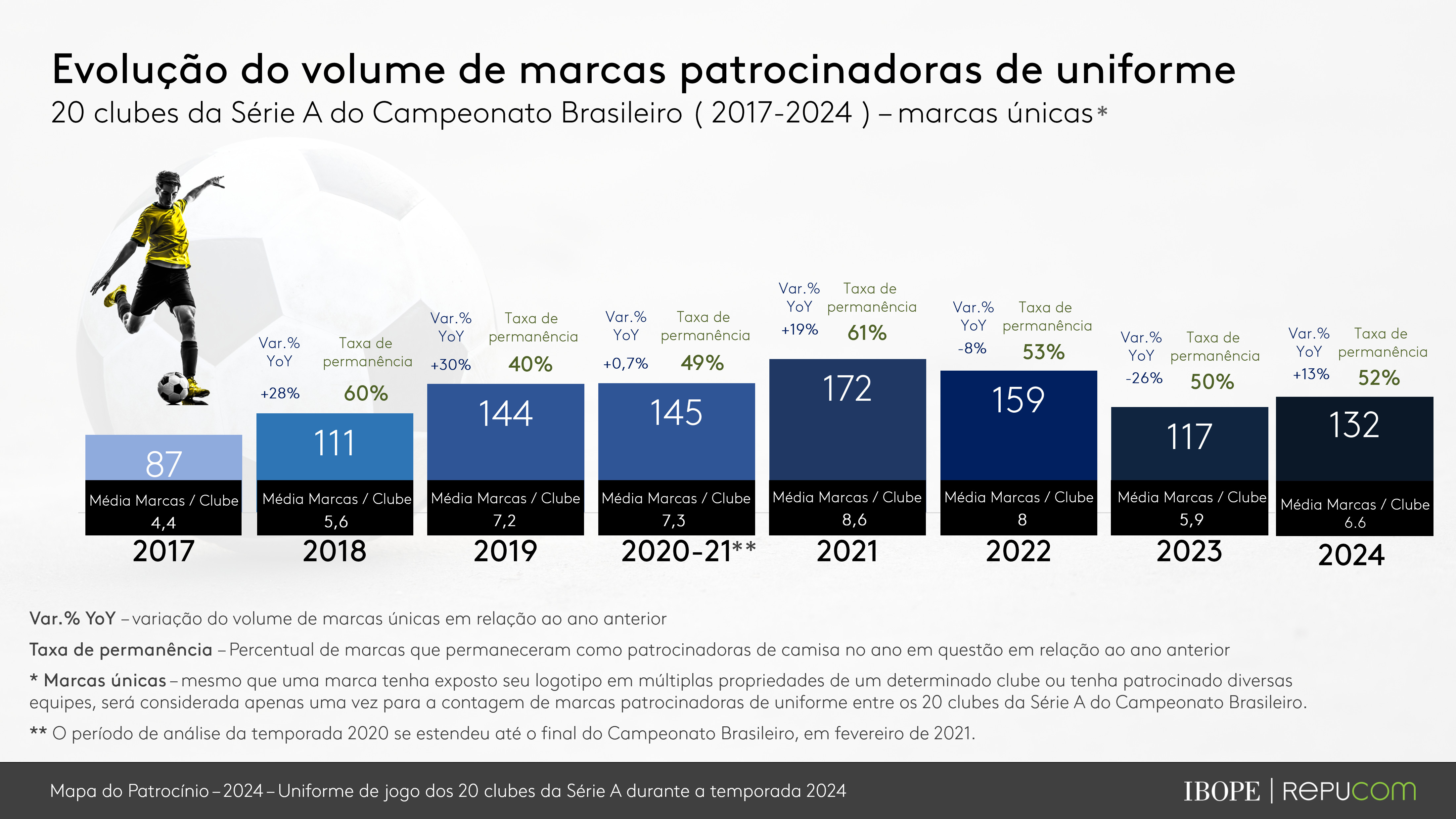

The 2024 season witnessed a vibrant sponsorship landscape. Across the 20 Série A clubs, a total of 132 different brands were showcased on uniforms. This represents a 13% increase compared to 2023, which saw 117 brands. A significant driver of this growth was a surge in short-term sponsorship agreements, jumping from seven in 2023 to 25 in 2024 – a remarkable 257% increase.

Brand loyalty in Brazilian soccer sponsorship remains noteworthy, with a 52% retention rate. This indicates that over half of the brands sponsoring in 2023 continued their partnerships in 2024, whether through regular agreements, short-term deals, or as sports apparel providers.

Evolution of Brands – Sponsorship Map 2017-2024

Evolution of Brands – Sponsorship Map 2017-2024

Danilo Amâncio, Marketing Coordinator at IBOPE REPUCOM, highlights the dynamic nature of the market: “The sponsorship market is highly dynamic, with around 50% of brands remaining as sponsors for more than a year. This turnover of new entrants is generally driven by thriving sectors or expanding categories. In this context, mapping the active brands investing in sponsorships in elite football identifies trends and reveals commercial opportunities that can even subsidize prospecting for other sports.”

Top 5 Sponsoring Sectors in Brazilian Soccer Uniforms

In 2024, the top sectors investing in Brazilian soccer uniform sponsorships were:

- Financial: Leading for the second consecutive year, with 20 brands.

- Betting: Featuring 15 brands, a significant increase from the previous year.

- Healthcare Services: With 13 brands, maintaining a strong presence.

- Food: Showing considerable growth with 11 brands.

- Real Estate, Construction, and Finishing: Represented by 7 brands.

Collectively, these five sectors accounted for 55% of all uniform sponsorships in 2024, demonstrating their significant investment in Brazilian football.

The Financial Sector, encompassing banks, financial institutions, brokers, and payment methods, experienced a 25% growth in brand participation, rising from 16 brands in 2023 to 20 in 2024. Consortia brands showed the most significant growth within this sector, while cryptocurrency brokerage brands saw the largest decrease in sponsorship deals.

The Betting Sector stood out with a strong presence across 18 clubs and featuring 15 unique brands. This marked a 25% increase from 2023, when 12 brands were present. For the third year running, betting companies dominated the coveted “master” sponsorship – the most prominent position on the uniform – securing 14 sponsorships with 11 different brands in this prime location. The betting sector also climbed to become the second-largest in terms of unique brand volume.

Healthcare Services, a consistent top performer since the 2021 pandemic season, maintained a strong presence with 13 brands on Série A uniforms in 2024, although this was a 7% decrease compared to 2023.

The Food Sector demonstrated substantial growth, increasing by 57% with 11 brands in 2024 compared to just seven in 2023. Notable examples include Hellmann’s and Perdigão, who engaged in short-term sponsorship deals with Cruzeiro for the 2024 Copa Sudamericana final.

In contrast, the Real Estate, Construction, and Finishing sector has been declining since 2022, recording its lowest sponsorship volume in the 2024 season. The sector totaled only 7 agreements in 2024, a 36% decrease from the previous season (11). This sector’s peak was in 2020 during the pandemic, with 30 brands.

Gabriella Giamundo, Business Development Manager at IBOPE Repucom, emphasizes the positive fan perception: “From the perspective of fans and consumers, the moment is highly favorable for sponsoring brands, with high recognition and purchase intent for sponsoring brands. According to data from IBOPE Repucom’s Sponsorlink survey, 76% of connected Brazilians agree that sponsorships are essential for the success of professional sports, and 63% state that they would buy products from brands that sponsor their favorite athletes or teams.”

For deeper insights and detailed information, download the complete report for free:

Link: Mapa do patrocínio de uniforme de futebol no Brasil em 2024

Source: 2024 Football Sponsorship Map in Brazil

This annual survey, released by IBOPE Repucom, tracks the evolution and trends in uniform sponsorships across the 20 clubs participating in the current Série A of the Brazilian Football Championship. Insper Sport Business supports this project.